Renewable Energy, Oil & Gas: Saudi Energy Trends H1 2024

Saudi Arabia is undergoing a significant transformation in its energy landscape, balancing its historical reliance on oil and gas with a robust push towards renewable energy. The ambitious targets set under the Saudi Arabia Vision 2030 are reshaping the energy sector, emphasizing the importance of diversifying energy sources and enhancing sustainability. This article delves into the trends observed in Q1 & Q2 2024, highlighting the interplay between renewable energy advancements and traditional oil and gas sectors, and how these dynamics are shaping Saudi Energy Trends Q1 & Q2 2024.

Shifting Paradigms: From Oil Dependence to Renewable Energy

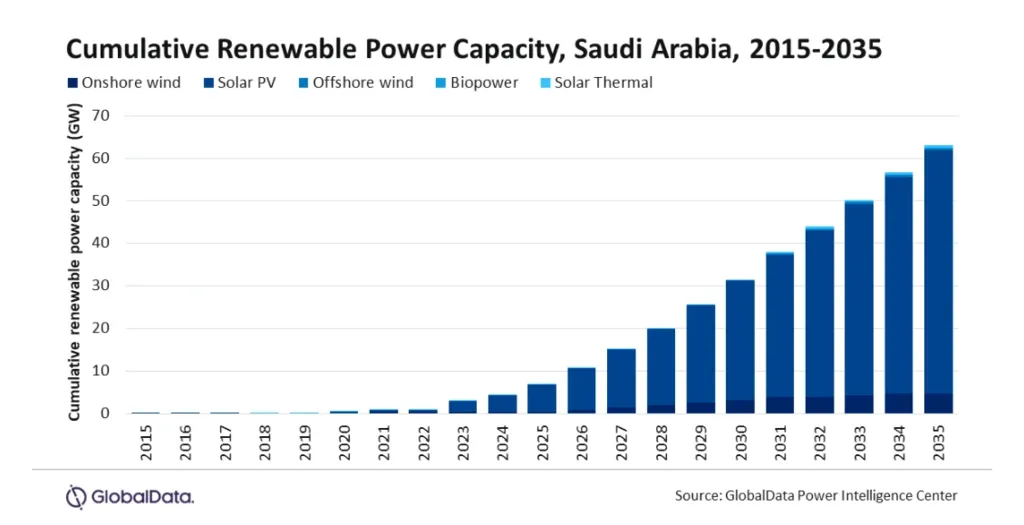

Saudi Arabia has long been a global leader in oil production, but the nation is now equally committed to becoming a powerhouse in renewable energy. The Saudi Vision 2030 initially set a target of 9.5GW of renewable energy by 2030. However, recognizing the urgent need to diversify its energy mix, the Kingdom revised this target to an ambitious 130GW by the same year. This shift is not merely about meeting domestic power demands but also about positioning Saudi Arabia as a key player in the global renewable energy market.

Key Trends in Q1 & Q2 2024

- Advancements in Solar Photovoltaic (PV) Systems

- Leveraging abundant solar radiation, Saudi Arabia is enhancing its solar energy capacity.

- Investment in bifacial solar panels, which capture sunlight from both sides, increases energy output.

- Wind Energy Innovations

- Improved turbine designs allow operation at lower wind speeds, expanding feasible locations for wind farms.

- Increased energy output from larger rotor diameters and taller towers.

- Energy Storage Solutions

- Tackling renewable energy intermittency with advanced energy storage technologies.

- Investments in lithium-ion batteries, flow batteries, and solid-state batteries to ensure stable power supply.

- Smart Grid and Digital Technologies

- Implementing smart grids for optimized energy distribution and reduced losses.

- Utilization of IoT, AI, and blockchain to enhance efficiency and transparency in energy management.

- Robust Policy Implementation and Investments

- Competitive auctions, regulatory frameworks, and financial incentives driving renewable energy growth.

- Over 8GW of renewable power projects under construction and 13GW in development by the end of 2023.

- Expected addition of over 20GW annually to reach the 130GW target by 2030.

Addressing Intermittency with Energy Storage Solutions

One of the main challenges of renewable energy is that it doesn’t always produce power consistently. However, new energy storage technologies are solving this problem by making the energy supply more stable and reliable. Saudi Arabia is investing in various storage solutions, including lithium-ion batteries and newer technologies like flow batteries and solid-state batteries.

Smart Grid and Digital Technologies: Enhancing Efficiency

The deployment of smart grid technologies and digital solutions is revolutionizing energy management in Saudi Arabia. Smart grids use real-time data and advanced analytics to optimize energy distribution, improve grid stability, and reduce energy losses. These systems can integrate various renewable energy sources, ensuring that the grid can handle the variability and intermittency of renewable power.

Digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), and blockchain are also being utilized to enhance the efficiency and transparency of renewable energy projects. For instance, AI algorithms can predict energy production based on weather patterns, while blockchain technology can make energy transactions safe and clear. These innovations are crucial components of the Saudi Energy Trends Q1 & Q2 2024.

The Role of Policy and Investment

The progress in Saudi Arabia’s energy sector is underpinned by robust policy implementation and substantial investments. Competitive auctions, regulatory frameworks, and financial incentives have been instrumental in driving the growth of renewable energy projects. By the end of 2023, over 8GW of renewable power projects were under construction, with an additional 13GW in various stages of development. These efforts are expected to add over 20GW annually, making the 130GW target by 2030 achievable.

Conclusion

Saudi Arabia’s energy landscape is rapidly evolving, with significant strides in both renewable energy and traditional oil and gas sectors. The interplay between these energy sources, driven by technological advancements and strategic policies, is shaping the future of the Kingdom’s energy market. As we monitor Saudi Energy Trends Q1 & Q2 2024, it is evident that Saudi Arabia is on a transformative path towards a more sustainable and diversified energy future.